How to Calculate Monthly Mortgage Payments Easily

Published on: May 1, 2025

Introduction

Purchasing a home is a significant milestone. Whether you're in Canada, the U.S., the U.K., India, or elsewhere, accurately estimating your mortgage payments helps in budgeting and making informed decisions.

In this guide, we break down mortgage components, buyer considerations, and how to use our free Mortgage Calculator to simplify the process.

Understanding Mortgage Payments

Your monthly mortgage payment isn't just repaying the money you borrowed. It’s a bundled total that includes four major components, commonly abbreviated as PITI:

- Principal: This is the amount of money you actually borrow from your lender to buy the home. For example, if your home costs $300,000 and you make a $60,000 down payment, your principal is $240,000. Over time, your payments gradually reduce this balance.

- Interest: This is the cost the lender charges you for borrowing the principal. It’s calculated as a percentage (the interest rate) and added to each monthly payment. In the early years of a mortgage, a large portion of your monthly payment goes toward interest.

- Taxes: Property taxes are assessed by your local government based on your home's assessed value. These are usually collected monthly by your lender and held in escrow until they’re due, ensuring you don’t miss any payments to the municipality.

- Insurance: This covers homeowner's insurance (protecting your home against fire, theft, and natural disasters), and may also include private mortgage insurance (PMI) if your down payment is less than 20%. The lender collects it monthly and pays your provider annually.

Understanding how each component contributes to your payment helps you evaluate how changes in your down payment, loan term, or property taxes can affect your monthly expenses. It also empowers you to ask better questions when comparing lenders or choosing between fixed and variable rates.

Factors Influencing Mortgage Payments

Several key variables shape the final number you see on your monthly mortgage statement. Whether you're comparing lenders or budgeting for your first home, understanding these can help you optimize your payment plan and avoid costly surprises:

- Loan Amount: The total amount you borrow plays a major role in your monthly payments. The higher the loan amount, the more you’ll pay each month. For instance, borrowing $500,000 instead of $400,000 at the same interest rate increases your monthly burden significantly — not just because of the principal, but also because of higher cumulative interest.

- Interest Rate: Even a small difference in interest rate (say, 5.0% vs. 5.5%) can add tens of thousands of dollars to your overall loan cost. Interest is calculated on the remaining loan balance, meaning you’ll pay more in the early years of your mortgage. A lower rate can dramatically reduce both your monthly payments and total lifetime cost.

- Loan Term: Common loan terms are 15, 20, or 30 years. Shorter terms (e.g., 15 years) mean higher monthly payments but much less interest paid over time. Longer terms (e.g., 30 years) reduce your monthly payment but significantly increase the total interest you’ll pay. It’s a trade-off between monthly affordability and long-term savings.

- Down Payment: Putting down a larger initial payment reduces your loan principal — which means smaller monthly payments. A down payment of 20% or more often eliminates the need for Private Mortgage Insurance (PMI), which can cost hundreds of dollars per month on top of your mortgage.

- Taxes & Insurance: These are frequently overlooked by new buyers. Property taxes vary widely by municipality and are usually based on the assessed home value. Homeowners insurance also varies based on property location, value, and risk profile (e.g., flood or earthquake zones). Combined, these costs can add several hundred dollars to your monthly bill.

Each of these variables interacts with the others — for example, a lower loan amount and a higher credit score can get you a lower interest rate, which saves money in both the short and long term. That’s why it’s crucial to experiment with different scenarios using a tool like our Mortgage Calculator.

Considerations When Buying a House

1. Affordability – The 28/36 Rule

Before you fall in love with a property, it’s essential to assess how much house you can realistically afford. A popular and time-tested budgeting guideline is the 28/36 rule, often used by lenders during the pre-approval process:

- 28% Rule: Your monthly housing expenses — including principal, interest, property taxes, and insurance (PITI) — should not exceed 28% of your gross monthly income.

- 36% Rule: Your total debt obligations (including mortgage, car payments, student loans, credit card payments, etc.) should not exceed 36% of your gross monthly income.

Example: If your monthly income is $5,000:

- Maximum housing budget: $5,000 × 28% = $1,400

- Maximum total debt load: $5,000 × 36% = $1,800

These numbers offer a helpful benchmark, but every household is unique. Try plugging in your own income and target percentages using our simple Calculator to see how your housing and debt ratios align with expert recommendations. It takes less than a minute.

These limits help protect you from becoming “house poor” — a term used when homeowners spend so much on their mortgage that they struggle to cover everyday expenses.

Alternative Strategy: 25% Take-Home Rule

Some financial advisors, like Dave Ramsey, suggest keeping your monthly mortgage payment under 25% of your take-home (net) pay. This is a more conservative approach that leaves more room for saving, investing, or unexpected expenses.

2. Credit Score – Your Interest Rate Weapon

Your credit score plays a huge role in determining what interest rate you qualify for. Even a 0.5% difference can mean thousands of dollars over the life of your loan. Here’s how scores typically affect rates:

- Excellent (760+): Qualifies for the lowest available rates

- Good (700–759): Still gets favorable rates

- Fair (650–699): May pay noticeably more in interest

- Poor (<650): Limited options; consider improving your score first

Tip: Check your credit report early, pay down credit card balances, avoid new debt, and don’t close old accounts. These steps can improve your score over 3–6 months.

3. Additional Costs – What Buyers Often Miss

Your monthly mortgage payment is just one piece of the puzzle. First-time homebuyers often underestimate these recurring and one-time costs:

- Closing Costs: Typically 2–5% of the home price. Includes legal fees, title insurance, appraisals, and loan origination fees.

- Repairs & Maintenance: Budget at least 1% of your home’s value per year for maintenance (e.g., $3,000/year on a $300,000 home).

- Utilities & Bills: Electricity, gas, water, sewer, trash collection, internet — these add up fast depending on location and home size.

- Property Tax Increases: Your tax bill could rise annually with reassessed home value — plan ahead, especially in appreciating neighborhoods.

- HOA Fees: If applicable, these fees cover community upkeep, amenities, or landscaping — and can be several hundred per month.

4. Emergency Buffer – Be Mortgage-Ready

Before buying, aim to have a 3–6 month emergency fund that covers your new housing expenses and daily living costs. Life happens — layoffs, unexpected repairs, or medical bills shouldn’t put your home at risk.

Final Thought: Buying a home is as much a financial decision as it is an emotional one. Using frameworks like the 28/36 rule or the 25% take-home strategy — combined with realistic budgeting — ensures that your dream home won’t become a financial burden.

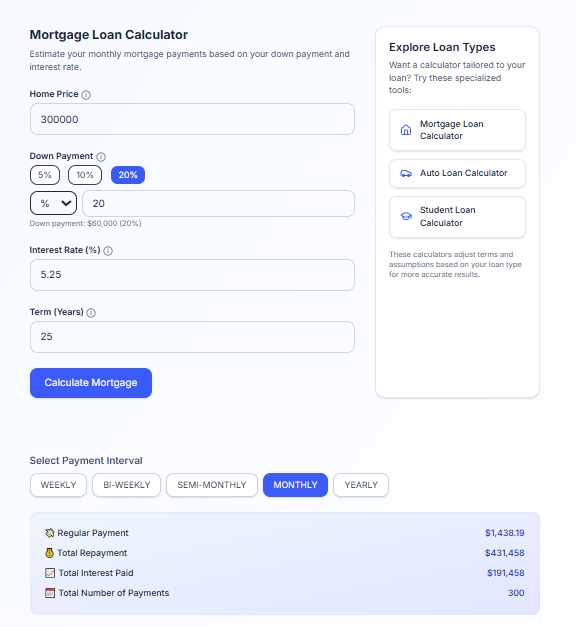

Using the Mortgage Calculator

Our Mortgage Calculator makes it incredibly easy to visualize your monthly payments based on the inputs you provide. It’s fast, responsive, and supports flexible payment intervals.

Start by entering these core values:

- Home Price: The total cost of the property

- Down Payment: The percentage or amount you’ll pay upfront

- Loan Term: Choose from 10, 15, 20, or 30 years (or custom)

- Interest Rate: Estimate your rate based on credit profile or pre-approval

- Taxes & Insurance (optional): Include them to get a more realistic monthly estimate

Then, select your preferred payment interval — whether monthly, bi-weekly, or even yearly. You’ll instantly see:

- Monthly Payment: Your regular principal + interest payment

- Total Interest Paid: Cumulative cost of borrowing over the loan term

- Total Repayment: Final amount paid over time (principal + interest)

- Amortization Schedule: A detailed breakdown of how your balance and interest shift each month

This tool is especially powerful for comparing scenarios — try adjusting the loan term or down payment to see how it impacts interest paid or total cost. Whether you're a first-time homebuyer or refinancing, this calculator gives you clarity with just a few clicks.

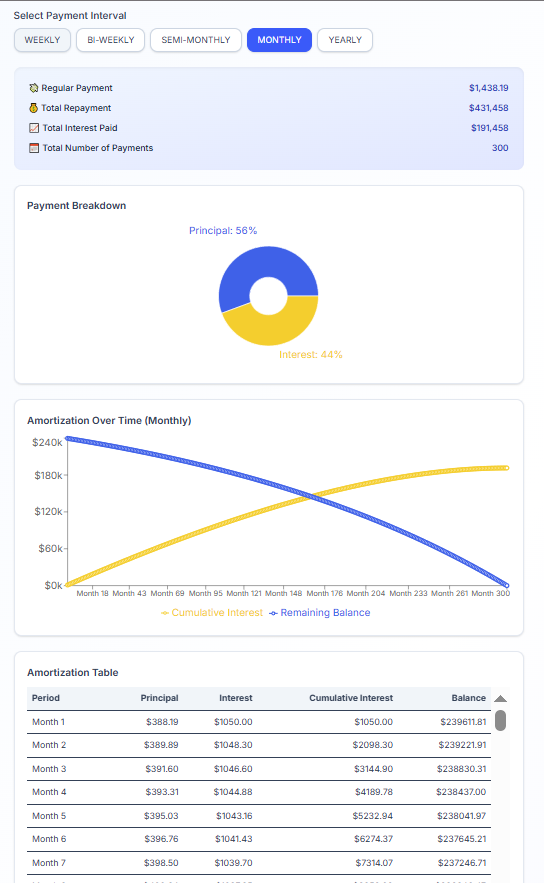

Amortization Schedule

An amortization schedule is a detailed breakdown of each mortgage payment over time — showing how much goes toward paying off the loan’s principal versus interest. When you make a monthly payment, it’s not applied equally: early payments primarily go toward interest, while later ones reduce the principal more significantly.

For example, on a 25- or 30-year mortgage, it’s common to pay thousands of dollars in interest before noticeably reducing your loan balance. This is due to how lenders front-load interest payments — a practice that makes amortization data extremely important for homebuyers and investors alike.

As time progresses, the proportion of your payment going toward principal increases while the portion going to interest decreases. This shift can be visualized clearly through charts and tables — giving you insight into:

- How quickly you're building home equity

- When it's most efficient to make extra payments to reduce interest costs

- Total interest paid over the life of the loan

- How much you still owe at any point in time

By understanding your amortization schedule, you can better plan your finances, time early paydowns strategically, and assess refinancing options when it makes sense.

Tools like our Mortgage Calculator automatically generate an interactive amortization chart and table. Use it to explore how adjusting your loan term, payment frequency, or interest rate can dramatically affect your financial picture over time.

Conclusion

Buying a home is one of the most important financial decisions you'll ever make — and being informed is your greatest asset. Understanding how mortgage payments work, what factors influence them, and how to calculate your affordability empowers you to plan strategically, avoid costly surprises, and build a secure future.

Whether you're just starting your homeownership journey or evaluating refinancing options, our Mortgage Calculator helps you run quick, accurate projections tailored to your situation — no signup, no confusion.

Thank you for reading. We hope this guide gives you clarity and confidence as you take your next financial step. And remember — every smart decision starts with the right tools.

Need to calculate more than just mortgages? Explore our full suite of tools including:

- Mortgage Calculator – Estimate home loan payments with PITI breakdowns and amortization tables.

- Auto Loan Calculator – Perfect for estimating monthly car payments and total loan cost.

- Student Loan Calculator – Understand how long it will take to repay your student loans based on your budget.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult a licensed financial advisor for personalized guidance.